Annuities vs Systematic Withdrawals: A Comparison of Flexibility and Security

- Bhanu Kiran

- Aug 30, 2025

- 5 min read

Updated: Oct 16, 2025

Retirement income choices determine not only financial stability but also the structure of control an individual retains over accumulated assets. The distinction between annuities and systematic withdrawals is not limited to product mechanics but extends to how each method allocates risk between the retiree and the financial institution.

Annuities transfer longevity and market risk to the insurer, while systematic withdrawals leave both under the individual’s management. This difference shapes liquidity, taxation, and intergenerational transfer, making the decision a matter of long-term economic design rather than a simple preference for payout style.

What is a Systematic Withdrawal Plan (SWP)

A Systematic Withdrawal Plan (SWP) is a facility offered by mutual funds that allows an investor to redeem a fixed sum at predetermined intervals such as monthly, quarterly, or annually. The withdrawals are executed by redeeming mutual fund units equivalent to the required amount at the prevailing Net Asset Value (NAV), while the balance corpus continues to remain invested and potentially earn returns.

Key features of an SWP include:

Income flow: Provides a consistent payout structure suitable for retirees or individuals seeking regular income.

Flexibility: The amount and frequency of withdrawals can be modified, enabling partial preservation of capital while meeting liquidity needs.

Investment impact: For instance, a corpus of ₹50 lakh invested in a fund yielding 13% annually can sustain withdrawals of ₹40,000 per month for 15 years and still leave a residual corpus of over ₹1.20 crore.

Minimum withdrawal: Most mutual funds set a floor of ₹1,000 per month, with some variation across asset managers.

Popularity: Adoption has been growing in India, particularly among retirees.

An SWP functions as a structured income mechanism that combines regular liquidity with ongoing market participation, positioning it as a flexible option within retirement income strategies.

What Are Annuities?

An annuity is a financial contract offered by insurance companies that provides guaranteed income either for life or for a fixed term. The purchaser pays a lump sum or a series of premiums, and in return, the insurer commits to making regular payments at defined intervals.

Types of Annuities

Immediate annuities begin payouts right after the initial investment, making them suitable for individuals who require income without delay.

Deferred annuities start payouts at a future date, allowing the invested amount to accumulate during the deferment period.

Fixed annuities provide a guaranteed rate of return and predictable payouts.

Variable annuities link returns to underlying investments, which can cause income to fluctuate with market performance.

Taxation and Regulation

Annuities fall under the regulatory framework of the Insurance Regulatory and Development Authority of India (IRDAI), which sets consumer protection standards. Premiums paid for annuity contracts are eligible for tax deduction under Section 80CCC up to ₹1.5 lakh. Income received from annuities is treated as taxable income according to the investor’s slab.

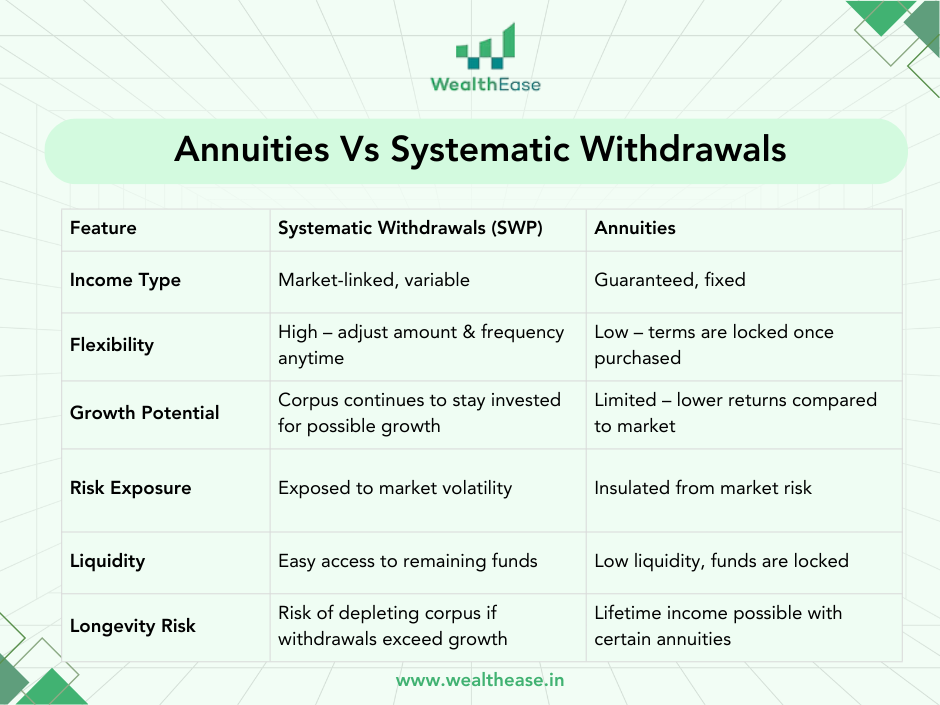

Annuities Vs Systematic Withdrawals: A Direct Comparison

The comparison between annuities and systematic withdrawals centers on income certainty, flexibility, risk management, return potential, inflation handling, liquidity, and taxation. Each dimension reflects a different way of structuring retirement cash flows.

The contrast shows that annuities concentrate on predictability and transfer of risk to the insurer, while systematic withdrawals emphasize flexibility, liquidity, and growth potential. The decision rests on whether the retiree prioritizes guaranteed stability or the opportunity to participate in market-driven returns with adjustable payouts.

Guaranteed Income Vs SWP: Which Suits You Better

Guaranteed income through annuities emphasizes security. The insurer takes on both longevity risk and investment risk, while the retiree receives predictable payouts.

Pros of guaranteed income:

Fixed monthly payouts, often ₹6,000–₹8,000 on a ₹10 lakh investment

No exposure to market volatility

Coverage for the retiree’s entire lifespan

Cons of guaranteed income:

Absence of inflation adjustment in most Indian annuity products

No residual corpus available for heirs once the contract is executed

Systematic Withdrawal Plans prioritize flexibility and growth participation. The investor retains control over both the pace of withdrawals and the remaining corpus.

Pros of SWP:

Potential returns of 10–12% annually from underlying funds

Adjustable withdrawals, such as sustaining ₹50,000 per month from a ₹50 lakh corpus for more than 15 years

Retained access to capital with the ability to leave a legacy

Cons of SWP:

Direct exposure to market volatility

Risk of premature corpus depletion if withdrawal rates are unsustainable

The choice depends on the investor profile. Younger retirees with longer horizons may benefit from drawdown strategies, while older or risk-averse individuals often prefer the stability of annuities.

NPS Withdrawals: How Much Should Go Into Annuities?

For retirees exiting the National Pension System (NPS), regulations require that at least 40% of the accumulated corpus be invested in an annuity to qualify for tax-free withdrawal of the remaining balance. The rest, up to 60%, can be withdrawn tax-free in a lump sum.

Should you allocate more than 40% into annuities?

No. The compulsory 40% already provides a baseline of guaranteed income. Allocating beyond this reduces flexibility and may lock funds into low-return structures.

What to do with the remaining 60%?

A better option is to invest the withdrawn portion into mutual funds. This approach delivers market-linked growth, and the ability to pass on a residual corpus to heirs.

Tax Treatment Of Annuities And Systematic Withdrawals

Taxation is a significant factor in evaluating retirement income strategies because it affects both net payouts and compliance requirements. The rules differ sharply for annuities and systematic withdrawals in India as of 2025.

Aspect | Systematic Withdrawals (SWP) | Annuities |

Equity funds | Long-term capital gains (LTCG) above ₹1 lakh taxed at 12.50% if units held >1 year; short-term capital gains (STCG) at 20% if redeemed within 1 year | Not applicable |

Debt funds | Taxed at slab rate, irrespective of holding period | Not applicable |

Withdrawal composition | Each payout includes a tax-free principal component and a taxable gains component | Entire income stream fully taxable at individual slab rates |

Taxation of contributions | No specific deduction on contributions | Premium payment deductible up to ₹1.5 lakh under Section 80CCC in old regime |

GST impact | Not applicable on withdrawals | GST may apply on annuity premiums at purchase |

Before we conclude the blog, let us invite you for a 1:1 financial planning session.

Conclusion

The allocation of retirement assets between annuities and systematic withdrawals is less a matter of product choice than of risk design. Each approach reflects a distinct trade-off between certainty, flexibility, and legacy.

The most effective outcomes are achieved when a financial advisory consultant calibrates exposure across both structures, ensuring that baseline expenses are covered by predictable income while discretionary or growth-linked needs remain tied to market-linked withdrawals.

FAQs

What is the difference between systematic withdrawal and annuity?

Systematic withdrawals redeem fund units at the prevailing NAV, so income varies with market returns and the corpus remains accessible. Annuities convert capital into guaranteed payments for life or term, transferring longevity and investment risk to the insurer and limiting liquidity.

Which is better, annuity or systematic withdrawals?

No single method fits all. Annuities suit baseline, nonnegotiable expenses that require certainty. Systematic withdrawals suit discretionary spending and growth objectives where flexibility and estate value matter. Many retirees combine both to match fixed needs with guaranteed income and variable needs with market participation.

What happens to SWP if the market crashes?

SWP payouts continue, but the units redeemed to meet each payout increase when prices fall. The corpus can shrink faster, raising the chance of early depletion unless withdrawals are reduced or the portfolio recovers.

Can you take monthly withdrawals from an annuity?

Yes. Annuity contracts can pay monthly, quarterly, or annually. The schedule is fixed at purchase and remains stable, providing predictable cash flow independent of market movements.

Do you get your money back in an annuity?

Usually not as a lump sum. Standard life annuities convert principal into income and limit access to capital. Variants such as return of purchase price or certain period options can provide benefits to nominees, often at the cost of lower payouts.

Comments